Taiwan Semiconductor Continues to Do a Great Job

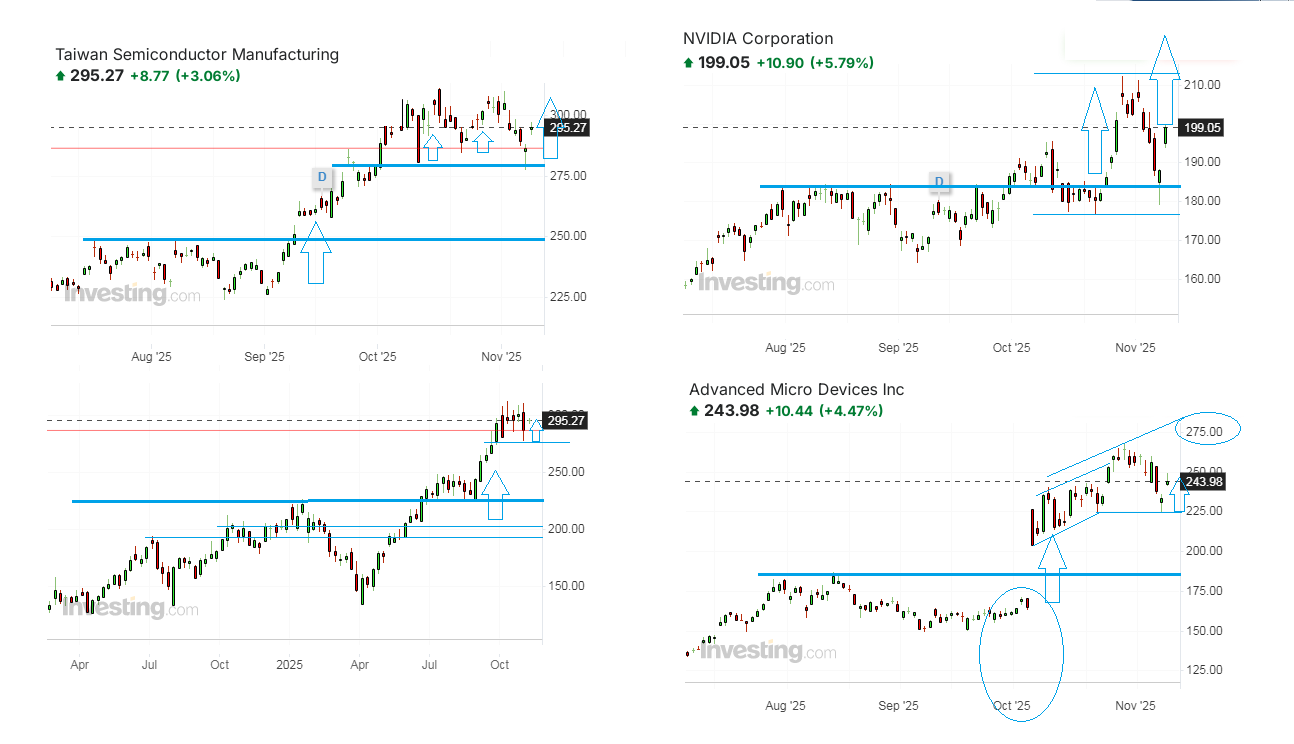

Shares of Taiwan Semiconductor (TSM), the world’s largest contract chipmaker, announced nearly 17% annual revenue growth 16.9% to an equivalent of $11.86 billion. The company's year-to-date sales production was up 33.8% vs the same 10-month period of 2024. This was also 11% above the prior month's achievement. TSM market value added more than 3% within the next trading day on the news, clearly poised to retake its all-time highs beyond $300 per unit, which were already more than $50 above this summer's highs near $250 and well above January's peaking price at $226.40. TSM is the most dedicated chip foundry if we mean it as a pure-play manufacturer, which is producing chips without designing its own. Still having a market share in the mid-60% range, it is a critical partner for most of the companies developing artificial intelligence (AI) chips. That's why TSM's outstanding achievements inspire optimism for all those investors who were seeking for any fresh driver to dispel doubts about the dominant AI-fuelled demand.

TSM is a key supplier to the AI darling NVIDIA (NVDA). The news helped NVIDIA shares to soar by 5.8% to $199.05 at Monday's closing to offset last week's correction. Just coincidentally or not, Nvidia CEO Jensen Huang said only several days ago that he had asked TSM for extra chip supplies. Other representatives of the chip segment also benefited a lot from this coordinated move up. Advanced Micro Devices (AMD) stock added about 4.5%, being only one step away from resurfacing $250, following dips below $225 last Friday. This significantly supported AMD positioning, which was exposed to increased volatility and contradictory expert estimates following the recent quarterly report.

No company is a separate entity in this industry anymore, because all of them are considered in close synergy by the investing minds. New price targets like $275 for AMD are now almost unquestioned, as well as $250 and higher for NVIDIA against the background of such a strong bullish power. For TSM itself, I would estimate the so-called measured move on charts, from a purely technical point of view, as $335 at least.

Disclaimer:

The comments, insights, and reviews posted in this section are solely the opinions and perspectives of authors and do not represent the views or endorsements of RHC Investments or its administrators, except if explicitly indicated. RHC Investments provides a platform for users to share their thoughts on financial market news, investing strategies, and related topics. However, we do not guarantee the accuracy, completeness, or reliability of any user-generated content.

Investment Risks and Advice:

Please be aware that all investment decisions involve risks, and the information shared on metadoro.com should not be considered as financial advice. Always conduct thorough research, seek professional advice, and exercise caution when making investment decisions.

Moderation and Monitoring:

While we strive to maintain a respectful and informative environment, we cannot endorse or verify the accuracy of all user-generated content. We reserve the right to moderate, edit, or remove any comments or posts that violate our community guidelines, infringe on intellectual property rights, or contain harmful content.

Content Ownership:

By submitting content to metadoro.com, users grant RHC Investments a non-exclusive, royalty-free license to use, display, and distribute the content. Users are responsible for ensuring they have the necessary rights to share the content they post.

Community Guidelines:

To maintain a positive and respectful community, users are expected to adhere to the community guidelines of Metadoro. Any content that is misleading, offensive, or violates applicable laws and regulations will be subject to moderation or removal.

Changes to Disclaimer:

We reserve the right to update, modify, or amend this disclaimer at any time. Users are encouraged to review this disclaimer periodically to stay informed about any changes.